The Consumer Price Index (CPI) rose 2.8% year-over-year in February, down from the 2.9% January pace and much slower than the 3.1% expected rate. Gasoline prices rose in Canada for the first time in five months, which led many analysts to forecast a rise in February inflation as seen in the US. However, offsetting the increase in gas prices was a deceleration in the cost of cellular services, food purchased from stores, and Internet access services.

Excluding gasoline, the headline CPI slowed to a 2.9% year-over-year increase in February, down from 3.2% in January. Prices for rent and the mortgage interest cost index continued to apply upward pressure on the headline CPI.

On a monthly basis, the CPI rose 0.3% in February, the same as in January. The most significant contributors to the monthly increase were higher travel tours and gasoline prices.

On a seasonally adjusted monthly basis, the CPI rose 0.1% in February.

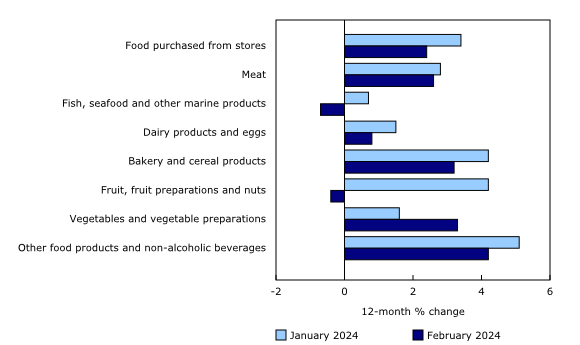

Prices for food purchased from stores continued to ease year over year in February (+2.4%) compared with January (+3.4%). Slower price growth was broad-based, with prices for fresh fruit (-2.6%), processed meat (-0.6%), and fish (-1.3%) declining. Other food preparations (+1.4%), preserved fruit and fruit preparations (+4.0%), cereal products (+1.7%), and dairy products (+0.6%) decelerated in February.

Price growth for groceries eases in February.

February was the first month since October 2021 that grocery prices increased slower than headline inflation. The slower price growth is partially attributable to a base-year effect, as food purchased from stores rose 0.7% month over month in February 2023 due to supply constraints amid unfavourable weather in growing regions and higher input costs.

While grocery price growth has been slowing, prices continue to increase and remain elevated. From February 2021 to February 2024, prices for food purchased from stores increased by 21.6%.