Hey brokers! I'm following up on my previous blog on how many leads you can obtain from a purchase transaction. A lot of you asked for the downloadable content which (for our team has been provided in our recent line of site email). For the rest, please email:

scott@thewestlaketeam.com. The CRM Checklist is a documents editable so you can customize to your business, but it provides a foundation on what type of opportunities exist for all your clients, be it purchase, refinance, renewal or decline - and what I used to turn 25 deals into 75 +. The checklist also reminds you on what activities you should be doing near closing for your clients and referral sources and additionally how to manage your data for CRM use!

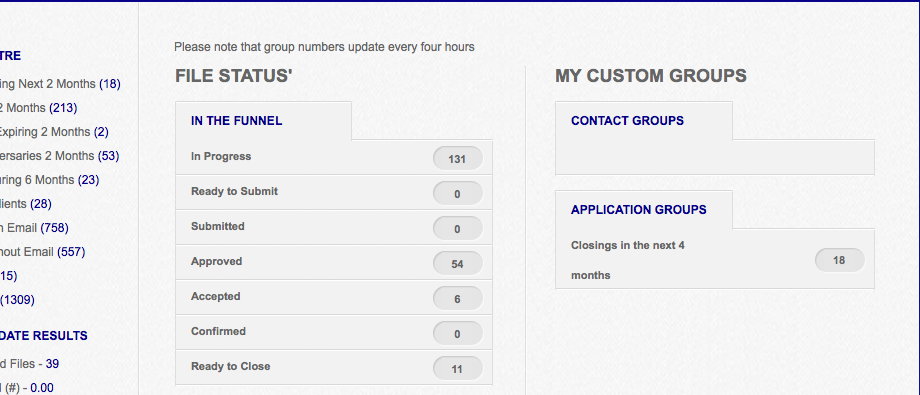

Today, I screen shotted one of a few CRM's I use for managing clients. We all may use different or smilier CRM and anyone that's been awhile knows that the best CRM is the one you are willing to use. Something is better than nothing!

For example, we track all our declines. We categorize them as "future mortgages." Just because a file didn't fund now be it: qualification, lost to competition, renewed at existing lender etc, thats a client, a lead, a relationship you can build on and a future mortgage you can potentially get when the opportunity is right. Never walk away from a deal or lead or opportunity and never stop tracking your data.

If I could go back and do one thing better, and a lot of top brokers say the same thing, is track data better. Our data precious! We work so hard for leads we need to track it and fin all ways. I highly recommend using our CRM checklist for your leads and customize it in a way that works best for you!

In our next blog well share what campaigns we are running that are working to get your phone ringing!